KKR Saudi Company

Background

KKR Saudi Company (the “Firm”) is a closed joint stock company established under the Regulations for Companies in the Kingdom of Saudi Arabia, Commercial Registration: 1010340484 Unified CR number: 7001691174, operating under a license from the Saudi Arabian General Investment Authority No. 102832119956 and is authorised by the Capital Market Authority to conduct Managing Investments and Operating Funds activities in the Securities Business No. 11154-10, as amended on May 23, 2024.

The direct controllers of the Firm are KKR Mena Holdings LLC, a limited liability company established under the laws of Delaware and Kohlberg Kravis Roberts & Co. L.P., a limited liability partnership established under the laws of Delaware.

Under its Managing License (Managing Investments and Operating Funds), the Firm is permitted to provide the following financial services:

(a) Distributing funds

(b) Identifying Potential Investors in KKR Funds

(c) Identifying potential investments opportunities.

The Firm is not permitted to engage in dealing, custody, or advising activities as defined by the CMA.

Paid Up Capital

The Firm has paid up capital in the amount of SAR 20,000,000.

Contact Information

KKR Saudi Company

Unit 702, Level 7,

3.09, District 3,

King Abdullah Financial District,

Riyadh, Saudi Arabia

Phone: +966 11 490-3767

Unified CR Number: 7001691174

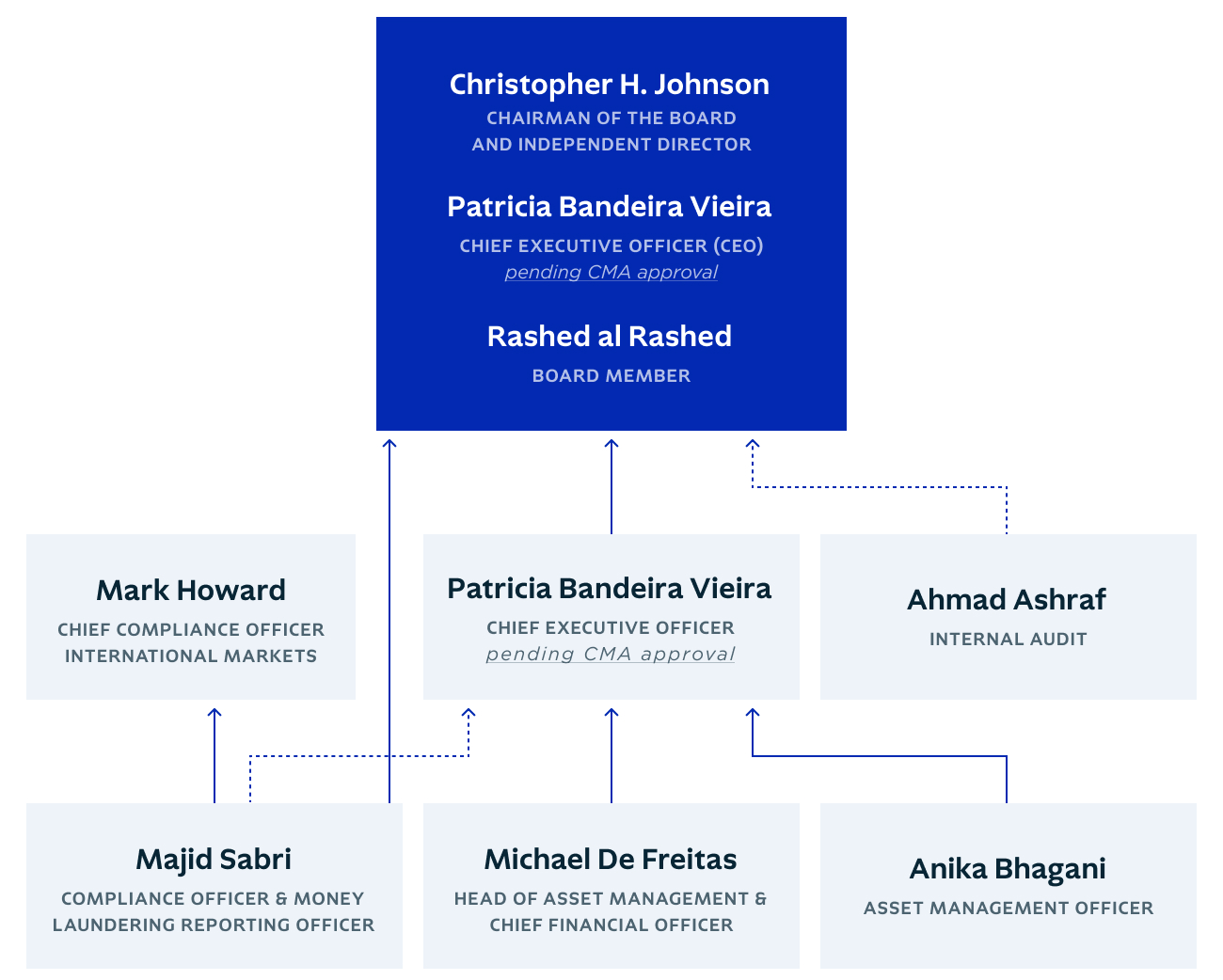

Board of Directors

Christopher Johnson (Chairman)

Rashed AlRashed

Christopher Johnson, Chairman, Board of Directors

Christopher Johnson was appointed Non-executive Chairman of the Board by Partners Resolution dated July 8, 2015. Mr. Johnson has been the Managing Attorney at the Al Sharif Law Firm since December 2010 and is responsible aspects of client services in the areas of corporate, regulatory (including financial services), litigation, intellectual property, and labor law. Previously, Mr. Johnson served for three years as President of the humanitarian airline AirServ, responsible for programs in some 20 third world countries and for ten years as Chairman of the Vint Hill Economic Development Authority responsible for the redevelopment of a former U.S. Army Base in Northern Virginia.

Mr. Johnson has a BA from Princeton University and Juris Doctorate from New York University. He is licensed to practice in the New York Bar and District of Columbia Bar.

Rashed AlRashed - Board Member

Rashed AlRashed was appointed as a board member for KKR Saudi in 2022. Mr. AlRashed is a highly accomplished board member with 15 years’ experience in highly regulated industries, an entrepreneur and business leader promoting innovation and creativity in various sectors. Mr. AlRashed developed a deep expertise in identifying, evaluating and mitigating risks as a business advisor to various company’s Board and Senior Management. He has a proven track record of leadership and management competencies, managing multidisciplinary teams across continents. He has led companies through their most important challenges and opportunities, often in complicated and highly visible, regulatory and investor environments relying on a remarkable background in Finance and Business Administration. Mr. AlRashed, Chairman of Hwadi since 2016, successfully navigated Hwadi through the uncertainty of the pandemic, spurring growth despite a very unstable world economy. Following his vision, he guided the company through the crisis, seeing the opportunities for growth in digitization as a core component of his strategy. Hwadi has become a hub and catalyst for technological development, where mobile apps, digital content creation, and virtual or hybrid conferences became an essential part of its services and business activities.

Senior Management

Patricia Bandeira Vieira– Chief Executive Officer (Pending CMA approval)

Patricia Bandeira Vieira (Dubai) joined KKR in 2020 and is a Director within Global Client Solutions. Ms. Vieira leads the EMEA Real Estate Client Solutions team and is also responsible for strategic partnerships in MENA across Private Equity, Infrastructure, Credit and Real Estate. She was previously based in the firm’s London office. Prior to joining KKR, Ms. Vieira was a director at Hines, having worked across the Investment and client solutions teams. Ms. Vieira holds an AB from Princeton University and an MBA from INSEAD. She is an active member of the Urban Land Institute and INREV.

Michael De Freitas – Head of Asset Management and Chief Financial Officer

Michael de Freitas (Dubai and Riyadh) joined KKR in 2022 and is a Director in Global Client Solutions. Prior to joining KKR, Michael was head of Middle East at Barings. Previously, he worked at Wellington Management on the global sovereign institutions team. He graduated from Heriot Watt University with a BA in Management. He is also a CFA charterholder.

Anika Bhagani – Asset Management Officer

Anika Bhagani (Dubai) joined KKR in 2022 and is a Director on the Global Client Solutions team. Ms. Bhagani leads KKR’s Real Estate and Infrastructure fundraising efforts across the Middle East, Africa and Central Asia. Prior to joining KKR, Mrs. Bhagani was an executive director at Goldman Sachs Asset Management, covering the Middle East, Africa and Eastern Europe. She holds a BSc in Management from The London School of Economics.

Organization Chart

Audited Financial Statements

Board Reports

Complaints

All complaints must be in writing to the Compliance Officer at [email protected] who will notify the customer that the complaint has been received and the Firm’s procedures for reviewing the complaint.

Please make sure that the following information is included in your communication to ensure a prompt handling of your complaint:

- Your identity and contact details (name, address and telephone number, email and whether you are acting on behalf of someone else;

- Reason(s) of the complaint (stating relevant dates and times, if applicable);

- Where relevant, copies of any documentation supporting your complaint.

The Firm will independently and impartially assess all complaints that are received without undue delay, and will provide a response no later than eight 8 weeks after receipt or a shorter deadline as might be required. We aim to resolve complaints as quickly as possible.

All complaint information will be handled in a sensitive manner and in accordance with any relevant data protection and regulatory requirements.